Explore web search results related to this domain and discover relevant information.

Learn what lease accounting is, why it matters, and how businesses track, report, and stay compliant with lease standards like ASC 842 and IFRS 16.

Whether your organisation is leasing property, equipment, or vehicles, your accounting team needs to keep track of how these leases affect your income statements, balance sheets, and overall financial health.If you manage leases across multiple assets, the right lease accounting software can help you stay on top of reporting requirements. These tools from MRI Software can automate calculations, reduce manual errors, and improve audit readiness.A finance lease transfers nearly all risks and rewards of ownership to the lessee. You’ll need to recognise both a right-of-use asset and a lease liability on your balance sheet. Depreciation of the asset and interest on the liability are accounted for separately.Transparent reporting of lease obligations allows better internal decision-making. It also supports investor confidence by giving them access to more accurate and consistent financial data. Whether you are leasing property, equipment, or vehicles, proper lease accounting makes your financial reporting more reliable.

Understand lease purchase agreements and how to account for them with this in-depth guide. Improve your lease management process with Visual Lease today.

Before diving into the accounting and tax considerations, let’s clarify what a lease purchase option is. A lease purchase option gives a lessee the right, but not the obligation, to buy the leased asset from the lessor.Lease Purchase Out of a Lease: If a lessee decides to purchase an asset they were previously leasing, and the lessor agrees, it’s a straightforward transition. There’s no need for advanced accounting; the asset shifts from being a leased asset to a fixed asset on the books.Lease Purchase Option: When the lessee holds a purchase option, the accounting approach hinges on their intent to exercise it. If the lessee doesn’t anticipate exercising the option, the lease is accounted for as a regular lease.However, if the lessee intends to exercise the option, a different accounting schedule is crafted based on that impending purchase. For the lease classification test, the timing of asset ownership transfer becomes vital.

It is this right of use that distinguishes a lease from other executory contracts. The rights of a lessee are different from those of an owner of an asset or a party to a service agreement that does not transfer a right of use. Nonetheless, a lessee does have certain rights that receive accounting ...

It is this right of use that distinguishes a lease from other executory contracts. The rights of a lessee are different from those of an owner of an asset or a party to a service agreement that does not transfer a right of use. Nonetheless, a lessee does have certain rights that receive accounting recognition as an asset (with a corresponding liability for the obligation to make payments for that right of use) because a lessee has control over an economic resource and is benefiting from the use of the asset.There is no specific measurement threshold to be met; judgment is required to determine how significant the supplier’s economic benefits should be for the substitution right to be substantive, thereby precluding lease accounting.As such, Manufacturing Corp could have a lease of the warehouse space beginning in year two of the agreement, provided the other criteria are met. Arrangement term that exceeds the economic life of the identified asset · The term of an arrangement may exceed the economic life of the identified asset. The accounting term of a lease cannot exceed the economic life of the underlying asset subject to the lease.It depends. If both the energy production and the RECs are deemed to be more than insignificant to the total economics, then neither party would have the right to obtain substantially all of the economic benefits and lease accounting would not apply.

Discover the difference between a lessor vs lessee and their benefits and obligations. Learn tips for approaching lease accounting for lessors and lessees!

Lease contracts play an important role in the day-to-day of most organizations. But does your business thoroughly understand the responsibilities of a lessee vs lessor? What about the benefits? These answers are critical to maintaining accurate and healthy lease accounting.Although different types of leases exist, such as finance and operating leases, the obligations have one thing in common. When it comes to lease accounting, leases must be reported accurately to meet regulatory compliance standards.Lessees must classify their leases as either finance or operating under the ASC 842 lease accounting standard. Both types of leases must appear in the organization’s balance sheet unless the term is 12 months or less, which is considered a short-term lease.Lessees now need to list all leasing obligations, including operating leases, on the balance sheet, categorizing them as either operating or finance leases. Lessors, who were already classifying leases, are less affected. Accurate classification and accounting are essential, and lease management software can assist in meeting these new requirements.

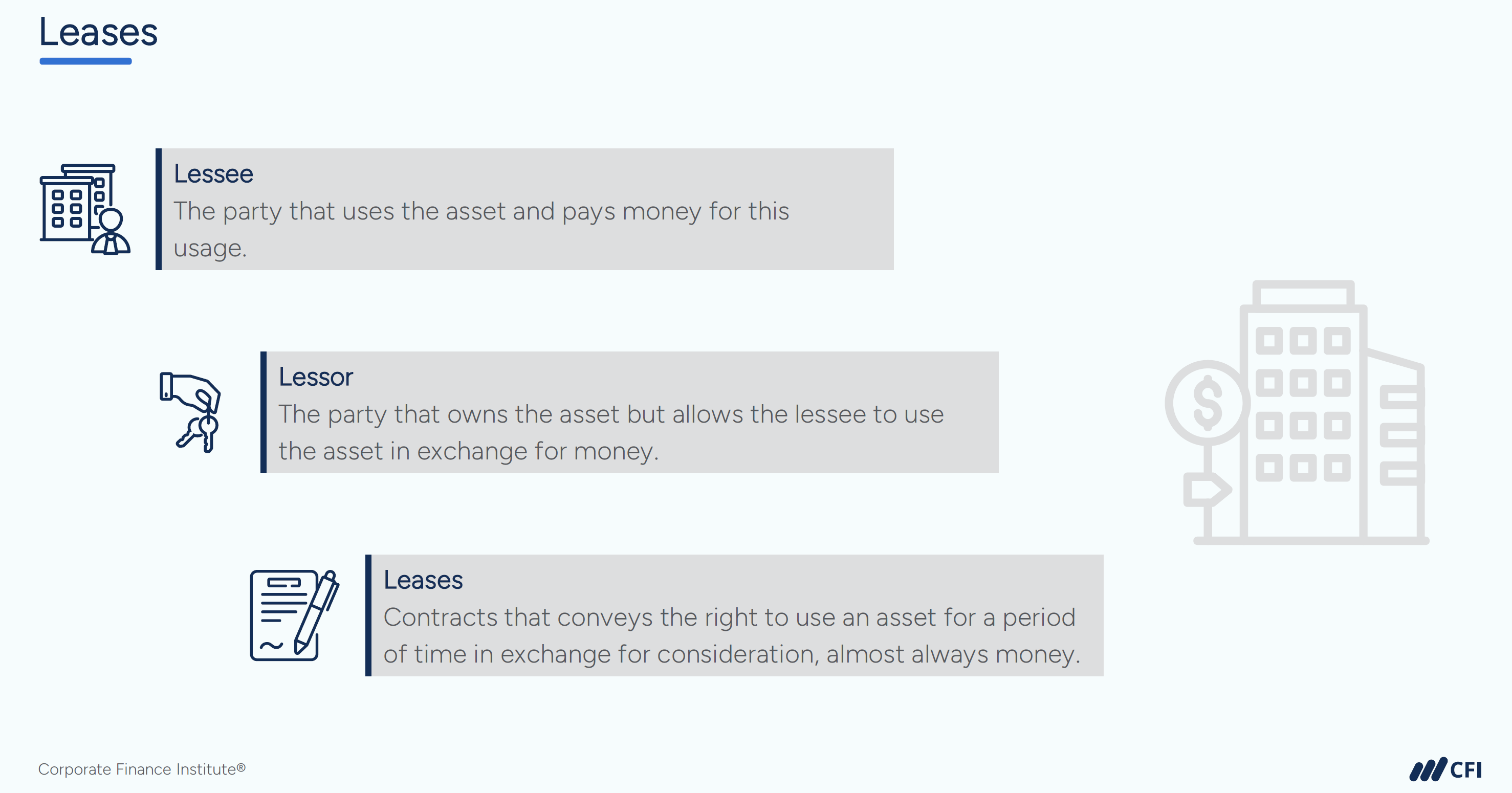

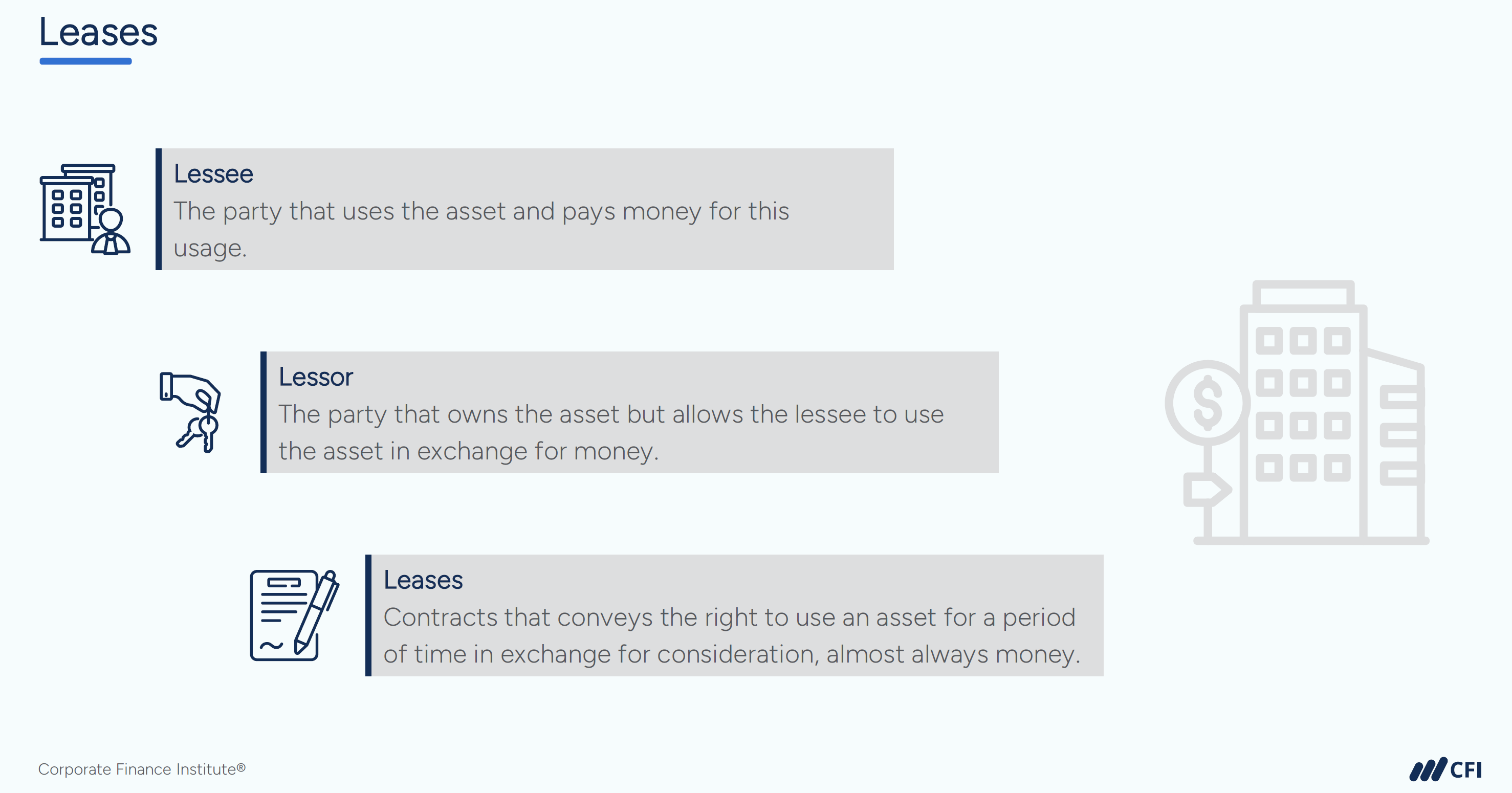

A lease is an arrangement under which a lessor agrees to allow a lessee to control the use of an asset for a period of time in exchange for payments.

Lease accounting is the process of recording and reporting lease transactions in an organization's financial statements in accordance with applicable accounting standards, such as ASC 842 or IFRS 16. It requires lessees to recognize most leases on the balance sheet by recording a right-of-use asset and a corresponding lease liability.In a sales-type lease, the lessor is assumed to be selling a product to the lessee, which calls for the recognition of a profit or loss on the sale. Consequently, this results in the following accounting at the commencement date of the lease:If the fair value of the underlying asset is instead equal to its carrying amount, then defer the initial direct costs and include them in the measurement of the lessor’s investment in the lease. In addition, the lessor must account for the following items subsequent to the commencement date of the lease:Recognize a selling loss caused by the lease arrangement, if this has occurred ... In addition, the lessor must account for the following items subsequent to the commencement date of the lease:

Explore the basics of lease accounting and find out how NetSuite can assist you in understanding and complying with the latest standards in this area.

If your business leases assets such as retail space, equipment, or vehicles to other businesses without transferring ownership to that company at the end, it’s classified as an operating lease. Under AASB 16, you must: Keep the asset on your books as a fixed asset. Record the payments from the lessee as income. Depreciate the asset according to your usual accounting policies.When the asset is used solely for business purposes, this lease payment is 100% tax deductible. However, when the asset, such as a company car, is provided as a benefit to employees, it may be subject to a fringe benefit tax. Consult your accounting professional to understand how specific assets are impacted.In addition to requiring lessees to identify ROU assets and lease liabilities on their balance sheets for almost all leases, these accounting changes also required companies to capitalise most operating leases on their balance sheets, instead of just reporting them in the footnotes.Short-term leases (those that last less than 12 months) are exempt from this ruling, with lessees retaining the option of whether to recognise short-term or low-value leases on the balance sheet. The International Accounting Standards Board (IASB) implemented new lease accounting rules, under IFRS 16 (which AASB 16 is based on), in January 2016.

Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for some consideration, usually money or other assets. The two most common types of leases in accounting are operating and finance (or capital) leases.

Operating Leases vs. Financing Leases (Capital Leases) ... Over 2.8 million + professionals use CFI to learn accounting, financial analysis, modeling and more. Unlock the essentials of corporate finance with our free resources and get an exclusive sneak peek at the first module of each course.Leases are contracts in which the property/asset owner allows another party to use the property/asset in exchange for some consideration, usually money or other assets. The two most common types of leases in accounting are operating and finance (or capital) leases.Lease accounting is important because it requires companies to record and fully report their lease obligations. This increased transparency helps stakeholders fully assess a company’s financial obligations.Traditional lease accounting standards changed several years ago with the adoption of Accounting Standards Codification (ASC) 842 for US GAAP companies and IFRS 16 for companies that report using IFRS. As discussed earlier, the previous accounting standards allowed certain leases to remain off the balance sheet.

Learn how to record lease accounting journal entries under ASC 842 & IFRS 16. Updated 2025 guide with real-world examples for accounting teams

In the world of accounting, lease accounting journal entries hold a significant place when it comes to financial reporting. As an accountant or financial analyst, you should adhere to certain reporting standards, such as IFRS 16 or ASC 842, for appropriately handling lease accounting transactions.When dealing with lease accounting, knowing the different frameworks and their implementation is crucial. IFRS 16 is an International Financial Reporting Standard that has been in effect since January 1, 2019, for annual periods starting on or after this date.As you navigate through the topic of lease accounting journal entries, you’ll gain a comprehensive understanding of the application and implications of these standards and be equipped with the knowledge needed to record lease-related transactions, resulting in accurate financial reports.If any of the above criteria are met, the lease is considered a finance lease. It is classified as an operating lease if none of these criteria are met. Classifying a lease affects the presentation of lease-related assets and liabilities on the financial statements and the accounting of lease payments and expenses.

Finance leases and operating leases are two common types of lease arrangements that businesses encounter. With the introduction of the ASC 842 accounting standard the classification and treatment of leases have evolved.

Risk and rewards: In any lease, the lessee usually takes on the risks and rewards associated with the leased asset. This includes responsibilities like maintenance, insurance, and any potential residual value. Accounting treatment: In financial accounting, finance leases are recorded on the lessee’s balance sheet as both an asset and a liability.The lessee does not usually have the option to purchase the asset at the end of the lease period. Maintenance and risk: The lessor is typically responsible for maintaining the asset and bearing the risks associated with ownership, such as changes in the asset’s value. Accounting treatment: From an accounting perspective, operating leases are generally not recognized as assets and liabilities on the lessee’s balance sheet.Under ASC 842, both finance leases and operating leases must now be recorded on the lessee’s balance sheet as right-of-use (ROU) assets and lease liabilities. However, the accounting for each type of lease differs. Finance leases result in the amortization of the asset and interest expense being recognized separately over the lease term, reflecting the lessee’s assumption of ownership.Lower upfront costs: No large purchase option or asset acquisition costs at the end of the lease. Simplicity: Easier to account for, with straightforward lease expense recognition.

ASC 842 changed how companies account for leases, replacing ASC 840 to bring more transparency to financial statements. Most leases, from office space to

ASC 842 is a lease accounting standard issued by the Financial Accounting Standards Board (FASB). It requires companies to record almost all leases on the balance sheet as right-of-use (ROU) assets and lease liabilities.How to use ASC 842 lease accounting depends on the lease type. For operating leases, the lessee records a right-of-use (ROU) asset and a lease liability on the balance sheet, with a single lease expense on the income statement.Example: A 3-year equipment lease at $12,000/year would create a lease liability and ROU asset reflecting the present value of payments. Under ASC 842, lessors account for leases based on type:NOTE: Our ASC 842 compliance solution simplifies lease accounting, provides transparency, and keeps organizations compliant with evolving standards.

Learn the basics of lease accounting and types of leases, why lease accounting is important, and how FASB and IFRS standards have changed.

The primary difference between the two is how they are accounted for on a company's financial statements. Finance leases are long-term leases of expensive assets, where the lessee takes on most ownership risks and rewards.It's important to consult the relevant accounting standards and seek professional advice for comprehensive and accurate lease accounting.* Transparency and Accuracy: Proper lease accounting enhances the transparency and accuracy of financial statements. By recording lease obligations on the balance sheet, it provides a more complete and accurate representation of a company's assets, liabilities, and financial position.Regulatory Compliance: Lease accounting standards, such as IFRS 16 and ASC 842, are recognized by regulatory bodies and accounting standard-setters. Compliance with these standards ensures that companies meet the requirements set forth by the respective governing bodies, avoiding potential penalties, legal issues, or reputational risks. Decision Making: Lease accounting information assists in making strategic decisions.The international standard for lease accounting is IFRS 16, issued by the International Accounting Standards Board (IASB). This standard applies to all companies that report under International Financial Reporting Standards (IFRS), which are used in many countries around the world. IFRS 16 follows the “right-of-use" model, which requires that if a company has the right to use an asset they are renting, it is classified as a lease for accounting purposes – and thereby must be recognized on the company’s balance sheet.

Get an overview of lease accounting, including new changes to the FASB, GASB, & IFRS standards and calculations for your lease portfolio.

Lease accounting is the process organizations use to record the financial impact of their leases. Businesses and other entities are required to record the majority of their leases on the balance sheet in accordance with the guidance established under standards from various accounting boards.The terms “lessee” and “lessor” are used to identify the different parties involved in a lease agreement. This distinction is important because the accounting for a lessor is significantly different from that of a lessee. When the various accounting boards for the domestic, international, and governmental entities issued these standards, the underlying definitions of lessor and lessee were not changed.They did, however, change some of the accounting treatment for lessors and lessees. A lessee is defined as the entity paying for the use of specific property from a lessor. For example, if a person leases a vehicle from a car dealership, the person using the car is the lessee.Conceptually, the lessee is paying the lessor for the “right to use” the asset. This is why the lessee, per the new lease standards, is required to recognize an intangible “right-of-use asset” (ROU asset) or a “lease asset” when accounting for the lease.

Lease Accounting: U.S. GAAP and IFRS Treatments for Operating Leases and Finance Leases and Full Valuation and DCF Impact.

We strongly recommend keeping these line items separate from “normal” Depreciation, Interest, and Debt Principal Repayments because Leases are not, in fact, normal Debt – despite the accounting treatment.Regardless of how companies record these line items, they still pay the same cash amount for their leases. If you go back to that principle, you’ll be able to understand everything above – even though the accountants want to confuse you as much as possible.Lease accounting is an unusual topic because the concept is more difficult than the real-life usage.Operating Lease Accounting Under U.S.

Explore our guide to ASC 842 Lease Accounting. Learn the differences from ASC 840, and how ASC 842 impacts lease recognition, measurement, and reporting.

The purpose of ASC 842 is to increase disclosure and visibility into the leasing obligations of both public and private organizations. Where previously most leases were not included on the balance sheet, the new ASC 842 lease accounting standard requires companies to report right-of-use (ROU) assets and liabilities for almost all leases.In addition, ASC 842 closely aligns with the new international lease accounting standard IFRS 16, especially in the way a lease is defined. This makes financial reporting more consistent for organizations with both U.S.If none of the criteria applies, then the lease would be considered an operating lease. Accounting for both the finance lease and operating lease are similar under ASC 842, unlike ASC 840.Under ASC 842, these improvements could be tracked separately from the right‑of‑use (ROU) asset and lease liability. thus when the improvements are funded by an incentive from the landlord, they do affect the ASC 842 accounting in different ways, commonly by reducing the initial ROU Asset if incentive is received in advance, or applying it as a payment credit if it will be received in a future month, leasehold improvements are amortized over the shorter of the improvement’s useful life or the lease term.

A capital lease is a contract entitling a renter to the temporary use of an asset and, in accounting terms, that has asset ownership characteristics.

To qualify as a capital lease, the agreement must meet at least one of several criteria, such as the transfer of ownership by the end of the lease, the option to purchase the asset at a bargain price, a lease term that spans most of the asset's economic life, and lease payments that closely reflect the asset's fair value. When at least one of these conditions is met, the lessee must account for the lease as if they own the asset.A capital lease requires the lessee to record the leased asset and associated liability on their balance sheet if the lease meets specific criteria. Essentially, a capital lease is treated as a purchase of an asset under generally accepted accounting principles (GAAP), while an operating lease is handled as a true rental agreement.The present value of lease payments must be greater than 90% of the asset's market value. In 2016, the Financial Accounting Standards Board (FASB) amended its accounting rules, requiring companies to capitalize all leases with contract terms above one year on their financial statements.In 2021, the FASB issued an update, requiring lessors to classify certain leases with variable payments as operating leases if they would otherwise be classified as sales-type or direct financing leases and result in a selling loss at the start. Effective from December 15, 2021, these changes refine lease accounting standards and impact how companies manage lease-related financials.

:max_bytes(150000):strip_icc()/Capitallease_final-d194fd2f2cae4acfa0b5b18a9be3c978.png)

Lease accounting is the process organizations use to record the financial impact of their leases. Businesses and other entities are required to record the majority of their leases on the balance sheet in accordance with the guidance established under standards from various accounting boards.

Lease accounting is the process organizations use to record the financial impact of their leases. Businesses and other entities are required to record the majority of their leases on the balance sheet in accordance with the guidance established under standards from various accounting boards.The terms “lessee” and “lessor” are used to identify the different parties involved in a lease agreement. This distinction is important because the accounting for a lessor is significantly different from that of a lessee. When the various accounting boards for the domestic, international, and governmental entities issued these standards, the underlying definitions of lessor and lessee were not changed.They did, however, change some of the accounting treatment for lessors and lessees. A lessee is defined as the entity paying for the use of specific property from a lessor. For example, if a person leases a vehicle from a car dealership, the person using the car is the lessee.Conceptually, the lessee is paying the lessor for the “right to use” the asset. This is why the lessee, per the new lease standards, is required to recognize an intangible “right-of-use asset” (ROU asset) or a “lease asset” when accounting for the lease.

Pay online, apply for additional equipment or software, update your account and more with MyLeaseAccount, your easy, convenient customer portal. Available anytime from any connected device, MyLeaseAccount makes it quick and simple to handle routine requests without a call to customer service.

Free E-Book: A Manager's Guide to Finance & Accounting · Access your free e-book today. DOWNLOAD NOW · Lease accounting is the process by which a company records the financial impacts of its leasing activities. Leases that meet specific classification requirements must be recorded on a ...

If your business rents its assets or leases from others, you need to track the financial impact those activities have on your business's financial health. This is called lease accounting and, in addition to being legally required, can help you run an organized, successful business.Free E-Book: A Manager's Guide to Finance & Accounting · Access your free e-book today. DOWNLOAD NOW · Lease accounting is the process by which a company records the financial impacts of its leasing activities. Leases that meet specific classification requirements must be recorded on a company’s financial statements.Related: Financial Statement Analysis: The Basics for Non-Accountants · Operating leases are leases that don't present an opportunity for the lessee to gain ownership of an asset.Financing leases, formerly called capital leases, are leases in which the lessee has reasonable expectation to gain ownership of an asset. Under the United States Generally Accepted Accounting Principles (US GAAP), there are five criteria, only one of which needs to be met for a lease to be considered a financing lease:

Sweeping changes to lease accounting are challenging businesses of all sizes — and their accountants. Here’s what’s causing the difficulties and how to avoid them.

Sweeping changes to lease accounting are challenging businesses of all sizes, and their accountants. Here’s the cause and how to avoid them.Among their many advantages, leases increase businesses’ purchasing power, decrease maintenance costs (if the lessee isn’t responsible for maintenance) and help better manage cash flow. However, accounting for leases has become an issue for many companies due to new accounting rules that began in 2019 for publicly traded companies and took effect at the end of 2021 for private companies.The changes include big philosophical shifts along with many small adjustments, with the primary change being that lessees are now required to carry the operating leases on their balance sheets if they last more than 12 months — the design is to give investors a better understanding of a company’s long-term liability. Complying with the new rules has proven to be more difficult than anticipated, especially for companies without the right accounting systems in place.Leases differ from rental agreements in many ways but the two most significant are duration and control. Rentals tend to be short-term — typically 30 days, max — while leases skew longer, often measured in years. Short-term leases have a duration of 12 months or less and lease accounting rules do not apply to them.

Because auditors are documenting CAMs related to lease accounting, lease accounting teams should understand what makes them so important.

Home About Us Log In Subscribe for Free My Account Log Out ... Technology Artificial Intelligence Automation Cloud Technology Digital Currency Hardware Security Software ... Because auditors are documenting CAMs related to lease accounting, lease accounting teams should understand what makes them so important.We get it. Sometimes the alphabet soup of leasing-adjacent terms is enough to make your eyes water and brain melt. That’s nothing, however, compared to the physiological reactions you’d have if your accounting team screwed up something very important to your company’s bottom line.Fair market value (FMV): The FMV is a key variable required for finance versus operating lease testing. It is also relevant for impairment calculations, when determining favorable or unfavorable terms during business combinations, and in other lease accounting business cases.This makes it critical to have lease accounting solutions that offer automation for impairment remeasurement events, fair market value determination and support with the industry standard market research data, and IBR matching technology to make sure the correct rate is chosen every time.

:max_bytes(150000):strip_icc()/Capitallease_final-d194fd2f2cae4acfa0b5b18a9be3c978.png)